Finding a certified jewelry appraiser near you ensures accurate, unbiased valuation of diamonds, gemstones, watches, and heirloom pieces so you can protect value for insurance, estate planning, resale, or donation. This guide teaches you how to define what “certified” means, compare the major credentials and credentials’ practical implications, and verify an appraiser’s standing using association directories and transparent documentation. Many owners struggle to know when to reappraise, which appraisal type they need, and how to avoid conflicts of interest; this article offers clear steps to solve those problems and includes checklists, comparison tables, and post-appraisal workflows. You will learn the step-by-step appraisal process from intake through lab testing and report delivery, how appraisal pricing usually works and what to avoid ethically, and how to use local search techniques and verification steps to find an independent expert. Throughout, we weave relevant keywords—certified jewelry appraiser, jewelry valuation expert, accredited jewelry appraiser, diamond grading report—and practical tools you can use immediately to locate and vet professional jewelry appraisal services near you.

A certified jewelry appraiser is a trained valuation professional who uses gemological testing, market research, and standardized appraisal methodologies to produce a documented value conclusion for jewelry. The mechanism behind accurate appraisal combines physical inspection, gemological lab testing (when required), and comparable-market analysis to determine replacement or fair market values that serve specific purposes. The clear benefit is an independent, documented valuation you can use for insurance, estate settlement, resale, or charitable donation, reducing financial risk and ensuring appropriate coverage. Understanding this definition helps you prioritize independence and credentials when searching for a local expert and prepares you to ask targeted verification questions when you contact candidates.

“Certified” indicates that an appraiser has completed recognized training, passed examinations, and typically meets continuing-education requirements set by credentialing organizations and appraisal associations. Certification usually involves classroom or online coursework and practical assessment in gemology, diamond grading, and appraisal methodology, which together enable accurate identification and valuation of gemstones and precious metals. The value for consumers is predictable competence: a certified appraiser is more likely to produce a report with standard sections, documented methodology, and signature that underwriters or courts will accept. To verify certification, ask for credential names, membership numbers, and proof of continuing education and then cross-check with association directories to confirm current standing.

Independence means the appraiser has no financial interest in buying or selling the item being valued; this reduces conflicts of interest that can skew valuation upward or downward. Independent appraisers follow ethical standards—such as those in Uniform Standards of Professional Appraisal Practice (USPAP)—to report objective conclusions and disclose any potential conflicts in writing. The practical effect for consumers is trustworthiness: independent, certified appraisers produce reports that insurers, executors, and buyers can rely on without concern about self-dealing. When vetting professionals, request a written independence statement and confirm that the appraiser does not operate a retail sales business that buys or sells items of the same type.

Owners seek appraisals for several common and critical situations that require documented valuations for legal, financial, or risk-management reasons. Below is a short list of the primary reasons and a one-line explanation for each use case.

1. Insurance Replacement Value: To set coverage limits that allow full replacement at retail prices in case of loss or theft.

2. Estate Planning and Probate: To equitably divide assets and support tax or probate filings with documented valuations.

3. Resale or Consignment: To establish a realistic asking price based on fair market value and comparable sales.

4. Charitable Donation: To substantiate a donation’s value for tax reporting when required by tax authorities.

These purposes determine the appraisal type you need and the level of documentation required, so understanding your intended use guides your choice of appraiser and report scope.

Reappraisal frequency depends on market volatility, the piece’s significance, and insurer requirements; a common guideline is every 2–5 years for items of material value. Precious metal and gemstone markets can shift significantly, and treatments or repairs can change a piece’s value, so event-driven triggers—such as price spikes, inheritance events, damage, or major repairs—warrant an immediate update. Insurers sometimes require periodic updates to maintain accurate replacement coverage, and estate planners recommend updating valuations when preparing or settling an estate. Keep copies of prior reports and note dates and valuation bases so new appraisals clearly explain changes from previous conclusions.

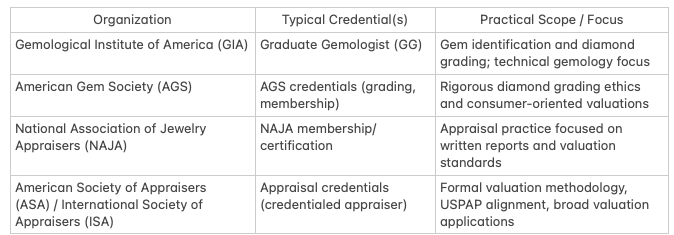

Credentials signal training focus, exam rigor, and practical competency; look for recognized designations from gemology and appraisal organizations to gauge expertise. Different credentials emphasize gemological identification, appraisal methodology, or both, and their practical value varies by use case—some are better for diamond grading and gem ID, others for formal valuation standards used in legal or insurance contexts. Verifying credentials involves checking official association directories, requesting certificate copies, and asking about continuing education and disciplinary history. Understanding which credential aligns with your appraisal purpose helps you choose an appraiser who is fit-for-purpose and credible to insurers and legal professionals.

What Are the Key Appraisal Organizations and Their Certifications?

Several authoritative organizations issue credentials that consumers commonly encounter; knowing the organization and credential provides insight into focus and scope. The entities below are frequent reference points in appraisal and gemology:

Summary: Check which organization issued the credential and whether it aligns with the appraisal purpose you need, prioritizing credentials that combine gemological skills with appraisal ethics.

Credentials differ by required coursework, exam rigor, and continuing-education obligations; some emphasize laboratory gemology while others center on valuation standards and ethical practice. A Graduate Gemologist (GG) credential from a major gemology school signals deep gem ID ability and diamond grading competence, whereas appraisal society credentials often require training in valuation methods, report writing, and adherence to appraisal standards like USPAP. For consumers, the practical takeaway is to prefer appraisers who hold both gemological and appraisal credentials when you need both accurate gemstone identification and defensible valuation conclusions. Ask whether the credential includes supervised experience hours and whether the appraiser maintains active standing and CE records.

Verification is a step-by-step process that confirms claims and exposes any disciplinary actions or lapsed membership. First, request the credential name, membership number, and a copy of the certificate; second, cross-check those details in the issuing organization’s directory or membership roster; third, ask for references and sample reports to assess report quality and format. Additionally, inquire about continuing education and whether the appraiser follows USPAP or equivalent standards; these confirm ongoing competency and ethical commitments. Verifying credentials before engagement provides confidence that the appraiser can produce the specific report you need for insurance, estate, or sale purposes.

A clear appraisal process follows intake, physical inspection, testing, market research, and written reporting, producing a defensible value conclusion tailored to the appraisal type requested. The mechanism combines observable data (measurements, hallmarks, condition), gemological testing (identification and grading), and market analysis (comparables and pricing guides) to reach a reasoned value. The main benefit is a documented, reproducible valuation you can rely on for insurance claims, court proceedings, or sale negotiations. Knowing the typical steps helps you set expectations for timeline, deliverables, and potential lab referral needs.

The initial examination documents the item’s physical attributes—weight, dimensions, markings, condition—and includes high-resolution photographs and notes on provenance if available. Appraisers use tools such as loupes, microscopes, calipers, and scales to record measurements and surface condition, and they document any hallmarks or maker’s marks for metal and origin clues. This stage separates preliminary observations from conclusive lab tests and establishes the descriptive backbone of the appraisal report. Clear photographic documentation and condition notes at intake also provide a reference for future valuation changes or insurance claims.

Gemological testing identifies gemstones and grades diamonds using standardized criteria (cut, color, clarity, carat) and may include refractometry, spectroscopy, or referral to a gemological lab for certification. Metal assays or hallmark verification determine metal content, while Market Trends on Jewelry Appraisals and market research draw on price guides, recent comparable sales, and retail replacement costs to form a reasoned value basis. The appraiser synthesizes lab data with local and national market comparables to reach a defensible conclusion that fits the appraisal type requested. Thorough research strengthens report acceptance by insurers, attorneys, and potential buyers.

A professional appraisal report includes a detailed description, measurements, gemstone identification and grading, metal content, condition, valuation conclusion, basis of value (replacement vs. fair market), signed appraiser statement, and photographs. The report should explicitly state assumptions, exclusions, and the effective date of value, and it should identify whether lab reports (e.g., diamond grading reports) were used as supporting documentation. These components create a transparent audit trail that recipients—insurers, estate executors, or courts—can evaluate independently. A well-structured report with clear methodology increases acceptance and reduces follow-up questions.

Turnaround time ranges from same-day for simple pieces to two to six weeks when specialized lab testing or extensive market research is required. Routine items with no lab referrals can often be inspected and reported within a few days, while pieces requiring gemological lab documentation or specialist consultation will extend timelines. Ask the appraiser for estimated delivery, milestones (inspection date, lab referral, draft report), and expedited options if you need faster service. Clear timeline expectations help you plan for insurance submissions, estate deadlines, or sale listings.

Selecting the right appraiser combines credential checks, evidence of independence, transparent fee structure, and sample reports that match your intended appraisal use. The mechanism that yields a reliable choice is structured vetting: ask targeted questions, verify credentials in directories, and compare sample reports for clarity and completeness. The benefit is a confident selection of an appraiser whose report will be accepted by insurers, legal counsel, or buyers without costly revision. Use the following lists and red-flag checks to make efficient, verified local choices.

Related Article: What to Expect During a Diamond Appraisal: A Step-by-Step Guide

When contacting candidates, ask focused questions that reveal competence, ethics, and fit for purpose; request sample reports and references to judge report quality. Useful questions include:

Watch for practices that undermine independence or indicate poor documentation—these are warning signs to avoid when selecting an appraiser. Common red flags include:

Identifying these red flags early prevents costly disputes with insurers or legal counterparts later.

Use a layered search approach combining official association directories, local referrals from attorneys or insurers, and verified online reviews to build a shortlist of candidates. Begin with credentialed directories from appraisal and gemological organizations, then cross-check candidates’ sample reports, client references, and professional affiliations. When narrowing choices, use targeted search queries like “certified jewelry appraiser near me” with local filters and then contact shortlisted appraisers to request an engagement letter and sample reports. This systematic approach reduces risk and speeds selection.

Similar Link: Top 5 Questions to Ask Your Jewelry Appraiser Before an Evaluation

After you narrow candidates, consider professional jewelry appraisal services for assistance: many offer independent appraisers for insurance or estate work and can coordinate lab referrals when necessary. Engaging professional jewelry appraisal services can simplify logistics while preserving independence if you confirm their ethical policies and report transparency.

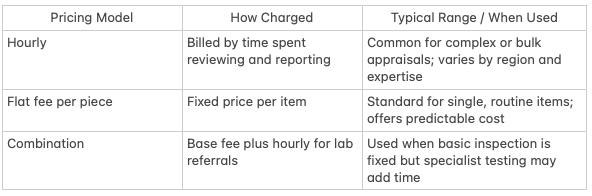

Jewelry appraisal pricing typically follows hourly, flat-fee per-piece, or combination models, with costs influenced by complexity, required testing, and travel; ethical providers avoid percentage-based fees. The mechanism behind pricing is the time and expertise needed for accurate identification, testing, research, and report preparation, and the benefit is a clear cost expectation tied to the appraisal’s scope. Knowing typical ranges and influencing factors helps you budget and choose the fee model that matches your needs.

Hourly billing charges for time spent on inspection, research, and reporting—useful for complex or bulk appraisals—while flat fees per piece are common for routine items and provide cost predictability. Hourly rates may apply when extensive lab testing or market research is required; flat fees suit standard rings or necklaces where scope is predictable. Professional jewelry appraisal services typically offer both models and will explain which applies based on item complexity and report use. Before engaging, request an estimate and a written fee agreement to prevent unexpected charges.

Summary: Confirm fee model in writing and seek an estimate that reflects whether lab referrals or specialist consultations are likely.

Primary drivers of cost include the item’s complexity, need for gemological lab testing, rarity of materials, quantity of pieces, geographic market rates, and travel or insurance obligations for high-value items. Complex heirlooms with multiple gemstones, unique settings, or uncertain provenance require more testing and research and therefore higher fees; routine bands or basic gemstone pieces typically cost less. If lab reports (e.g., diamond grading reports) are needed, expect additional charges for testing and report procurement. Understanding these factors helps you anticipate costs and choose the right appraisal scope.

Read More: A Guide to Jewelry Appraisal: Types and Benefits

Percentage-based fees create an inherent conflict of interest because the appraiser’s compensation grows with the reported value, undermining the report’s independence and credibility. Ethical appraisal practice favors flat or hourly models that separate valuation conclusions from appraiser compensation and align incentives with objective analysis. If an appraiser suggests a percentage fee, request a flat or hourly alternative and insist on a written engagement that documents fee structure and independence. Clear, ethical fee agreements protect both you and the receiving parties who will rely on the report.

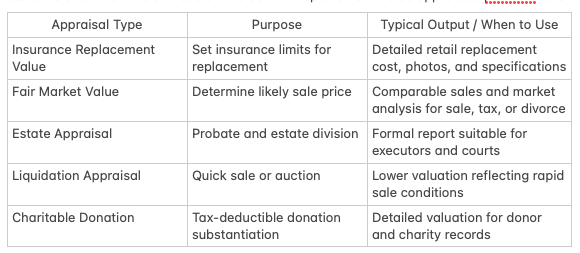

Different appraisal types use distinct valuation bases and suit different legal, insurance, or transactional needs; choose the type that matches your intended use to ensure report acceptance. The mechanisms differ—replacement value targets retail replacement cost, fair market value reflects likely sale price, estate appraisals serve probate, liquidation focuses on quick sale price, and donation appraisals support charitable tax reporting. Selecting the proper type prevents disputes and ensures the report meets recipient requirements.

An insurance replacement value appraisal estimates the retail cost to replace an item with an equivalent piece at current prices and is used primarily to set adequate insurance limits. This appraisal typically lists retail replacement costs, describes assumptions (such as availability of matching items), and provides detailed photographs and specifications to support the insured amount. Insurers often require replacement-value reports for high-value items to avoid underinsurance, and the report should clearly state the effective date and basis of valuation. Replacement-value appraisals prioritize retail replacement cost rather than resale proceeds.

Summary: Match the appraisal type to your intended recipient—insurer, estate attorney, buyer, auctioneer, or charity—to ensure acceptance.

Fair market value (FMV) estimates the price a willing buyer would pay a willing seller in an open market, using comparables and current market demand to reach a reasoned conclusion. FMV is often used for sales, tax reporting, divorce settlements, or estate distributions where actual sale conditions are expected over time rather than immediate retail replacement. The appraiser documents comparable sales and market context to justify the FMV conclusion, making the report defensible in negotiation or legal contexts. FMV differs from replacement value by focusing on likely sale proceeds rather than replacement cost.

Estate appraisals are required for probate and estate settlement to allocate values among heirs and support tax filings, while liquidation appraisals focus on quick dispositions where timing reduces achievable value. Executors often require estate appraisals that follow formal valuation methodologies and provide documentation suitable for courts or tax authorities. Liquidation valuations are used when rapid sale is necessary, such as downsizing an estate quickly or preparing lots for auction, and the report emphasizes realistic sale expectations under constrained timelines. Choosing between estate and liquidation appraisal depends on executor goals and required reporting standards.

Donation appraisals substantiate the value of jewelry gifted to charities and provide donors with documentation needed for tax reporting when thresholds require a professional appraisal. These appraisals must state the basis of value, the effective date, and whether the donor received any goods or services in return, and they often follow tax authority guidelines for acceptable documentation. Donors should verify charity receipt policies and tax rules in their jurisdiction and obtain a signed appraisal that meets applicable thresholds to support deductions. Proper donation appraisals protect donors from future tax disputes.

Keeping appraisals current ensures adequate insurance coverage, accurate estate records, and readiness to sell or recover loss; a maintenance rhythm combines scheduled reviews with event-triggered updates. The mechanism is simple: follow a reappraisal cadence, submit documentation correctly to insurers or estate professionals, and store reports and supporting documents securely. The benefit is reduced risk of underinsurance, clearer estate settlement, and faster claims processing in loss situations.

Regular reappraisal captures market-driven changes in metal and gemstone values and prevents underinsurance and estate misvaluation as markets evolve. Precious metals and gemstones can fluctuate materially, and treatments or provenance discoveries can change an item’s worth, making periodic updates essential to reflecting current value. Reappraisal every 2–5 years is a common guideline, with immediate updates after repairs, loss of documentation, or significant market shifts. Maintaining current appraisals protects against coverage gaps and supports accurate estate accounting.

Submitting an appraisal involves providing the signed report, photographs, original receipts (if available), and any supporting lab certificates to the insurer or estate attorney along with a cover letter explaining purpose and effective date. Insurers often require a copy of the appraisal and may request appraiser contact information for verification; estate professionals need the report as part of the estate inventory and may require additional provenance documentation. Keep digital and physical copies and note submission dates and recipient contact details to track acceptance and any follow-up requests. Clear submission practices speed acceptance and reduce administrative friction.

Updated appraisals ensure adequate insurance coverage, simplify resale or estate settlement, and accelerate claims processing if loss or theft occurs. An up-to-date appraisal provides current replacement or FMV amounts that prevent underinsurance, supports fair division of assets in estates, and supplies the documentation insurers and buyers expect during valuation disputes. For theft recovery, an accurate report with photographs and serial numbers expedites police and insurer processes. Maintaining updated appraisals ultimately reduces financial and administrative risk for owners.

For next steps, consider contacting professional jewelry appraisal services to arrange a vetted, independent appraisal and to access association directories or lab referrals mentioned throughout this guide. Professional jewelry appraisal services can help coordinate inspection, testing, and report delivery while ensuring the appraiser follows documented standards and ethical fee structures. Use the checklists and verification steps above when engaging services to confirm independence and report suitability for insurance, estate, or sale purposes.